Compensation, Pricing, and Value

For independent financial advisors, the conversation about compensation can be complicated—but it’s one that we can help simplify:

At Commonwealth, you may retain between 95 percent and 100 percent of your revenue, depending on how you affiliate with us. That’s the revenue you worked for, and you decide what to do with it. We believe that investing in you means enabling you to invest in your firm.

You can tap into a comprehensive suite of products, services, and solutions to meet your clients’ needs today and in the future. And by supporting your clients on their financial journey, you're supporting your success in the long term.

Choose what's necessary for your unique clients and practice. It's all about offering flexibility, not just bundled solutions.

Independence, Simplified

If you’re coming from an employee-based model, understanding your compensation as an independent advisor can take some time.

The upside is that you have more control over your gross production and revenue. But, as a new business owner, you’ll need to consider costs you likely don’t currently pay, including:

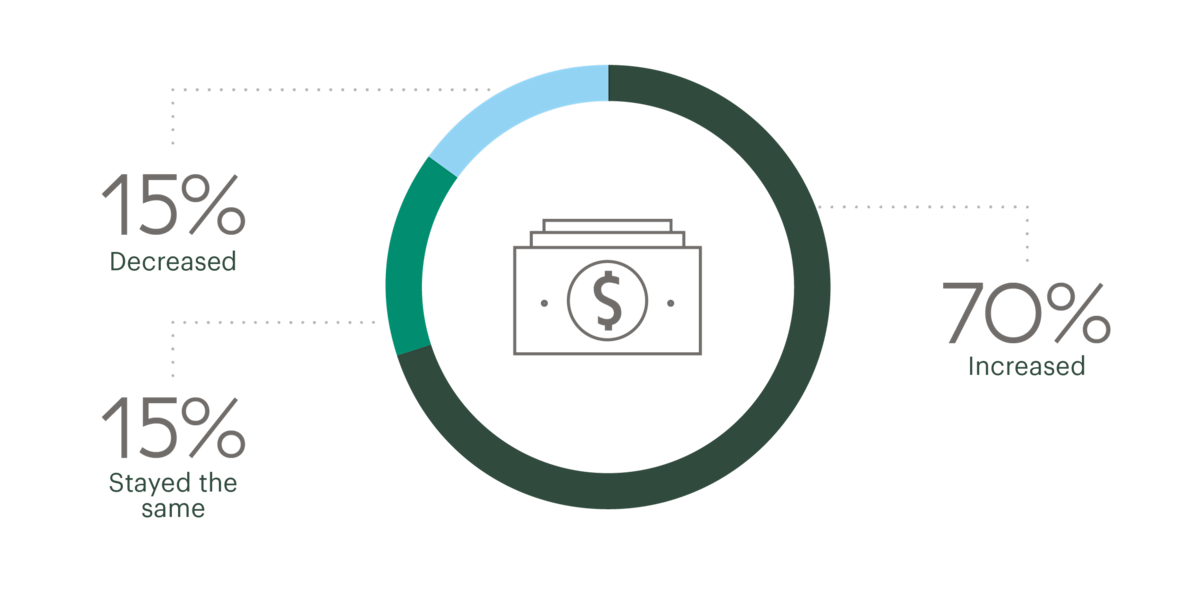

And, while increased costs can be a concern, 85 percent of advisors who go independent reported that their compensation didn’t decrease.

Source: Charles Schwab Independent Advisor Sophomore Study, 2018

A Positive Change

As an independent advisor with Commonwealth, you can choose what you want and not pay for what you don’t need. And you can expect to see a more positive earnings statement than before.